The Datalex Big Book of Airline Data is a treasure trove of worldwide airline operational data, including passenger traffic, airline revenue, and frequent flyer enrollment data for 221 airlines. The Big Book is sponsored by Datalex and created by the team at IdeaWorksCompany. You can download a copy free of charge here.

The team at IdeaWorksCompany spent months scouring and researching airline financial reports, publications, and announcements to vet the information presented in the Big Book.

Information in the Big Book may prove very valuable in the following scenarios:

- An airline researching current top competitors by region

- An airline researching new regional markets and the competitors they would compete against

- An airline researching partners to extend their reach into new regional markets

- An airline seeking to understand the subsidiary structure of a competitor

- A member of the press seeking information about the airline industry

- An academic researcher publishing research on the travel industry

- A financial researcher publishing research on entities and segments in the airline industry

These are just a few of the use cases where Big Book data could be useful.

The following are some interesting insights that can be gleaned from the Big Book data.

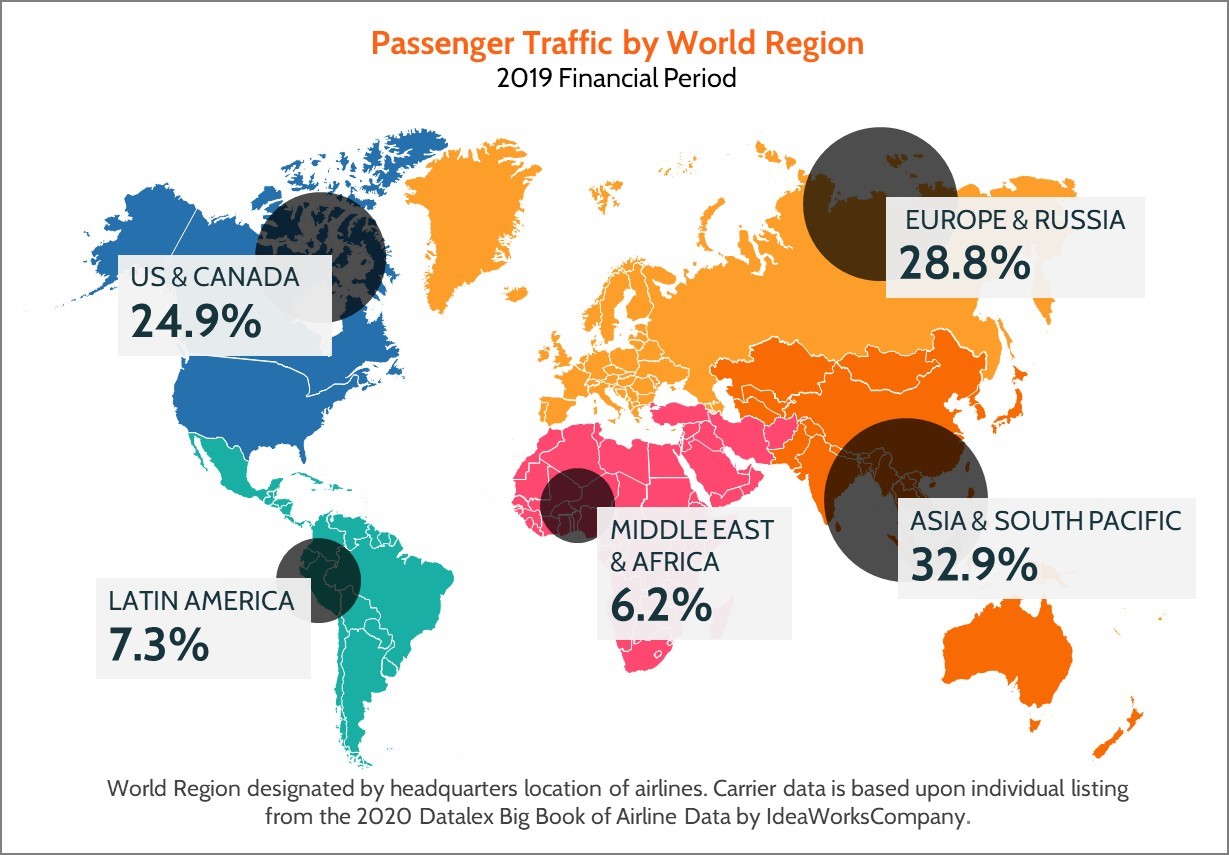

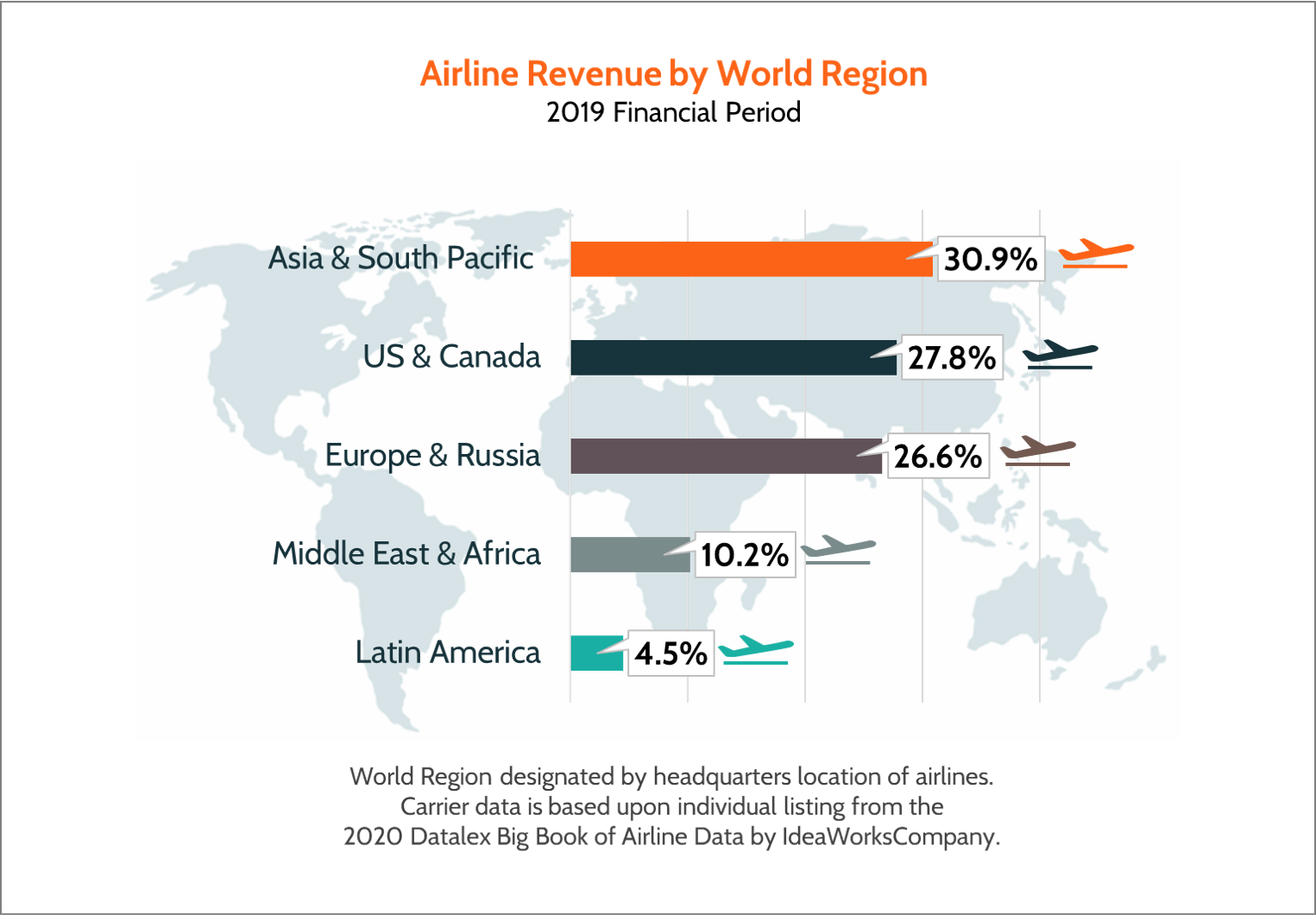

1. Based on Passenger Traffic, the Asia & South Pacific region is the largest in the world.

This points to Asia’s growth as a financial powerhouse and a growing middle-class with discretionary income to spend on travel. While Asia & South Pacific lead in passenger traffic, the North American region continues to lead in gross revenue production.

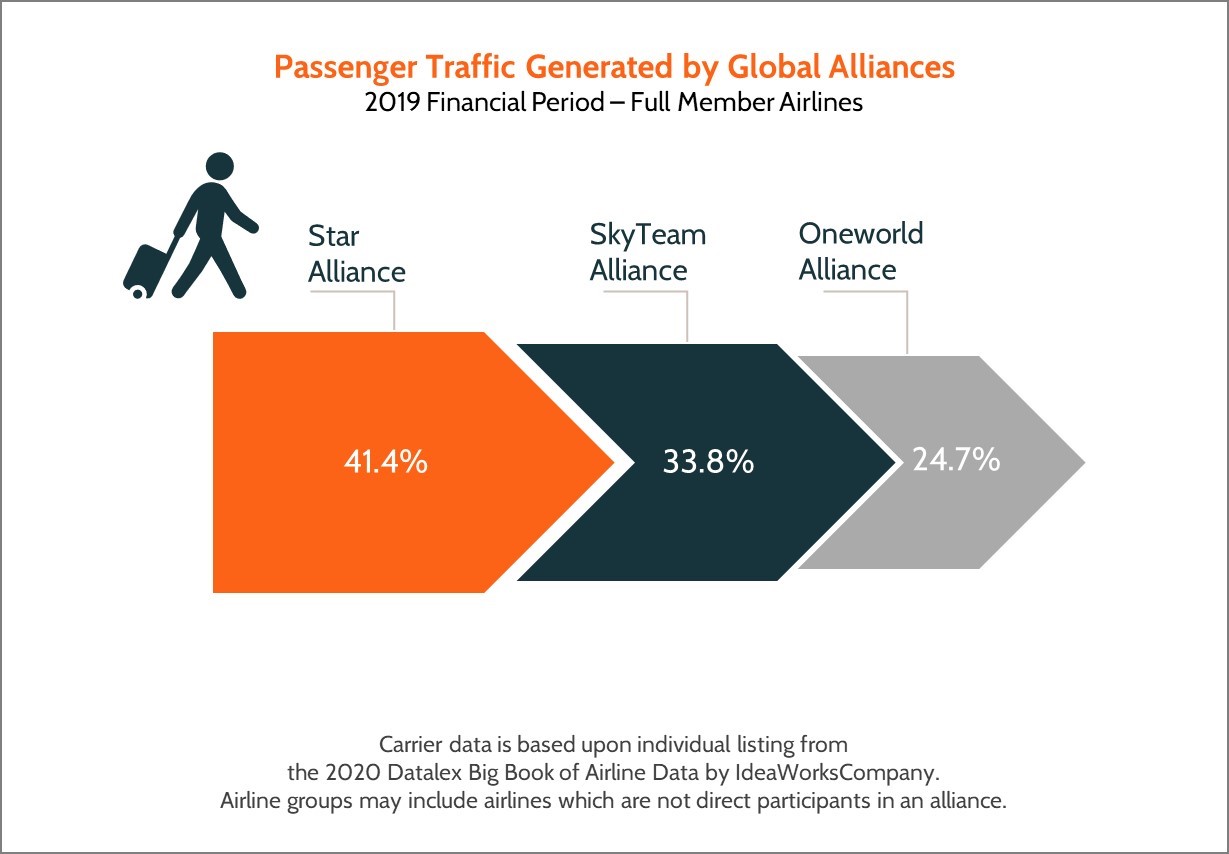

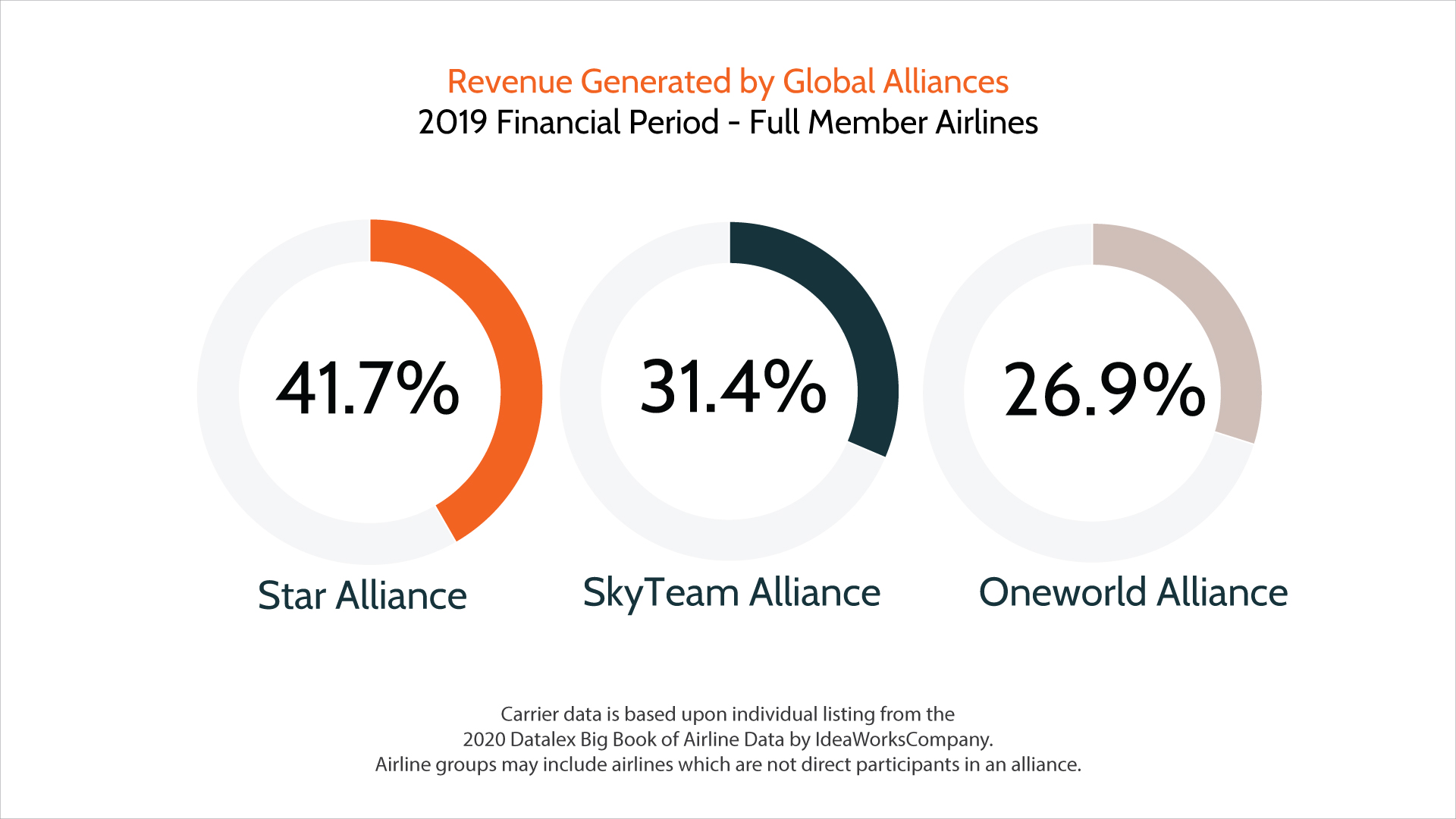

2. Alliances appear to be dominating capturing passengers.

44% of all passengers are travelling on airlines in an alliance. The Star Alliance is the largest with 41% of all alliance traffic. While not confirmed in the Big Book data, this may point to passenger preference for travelling on alliance affiliated airlines. It could be worthwhile for a non-alliance airline to survey their passenger base for interest in alliance membership.

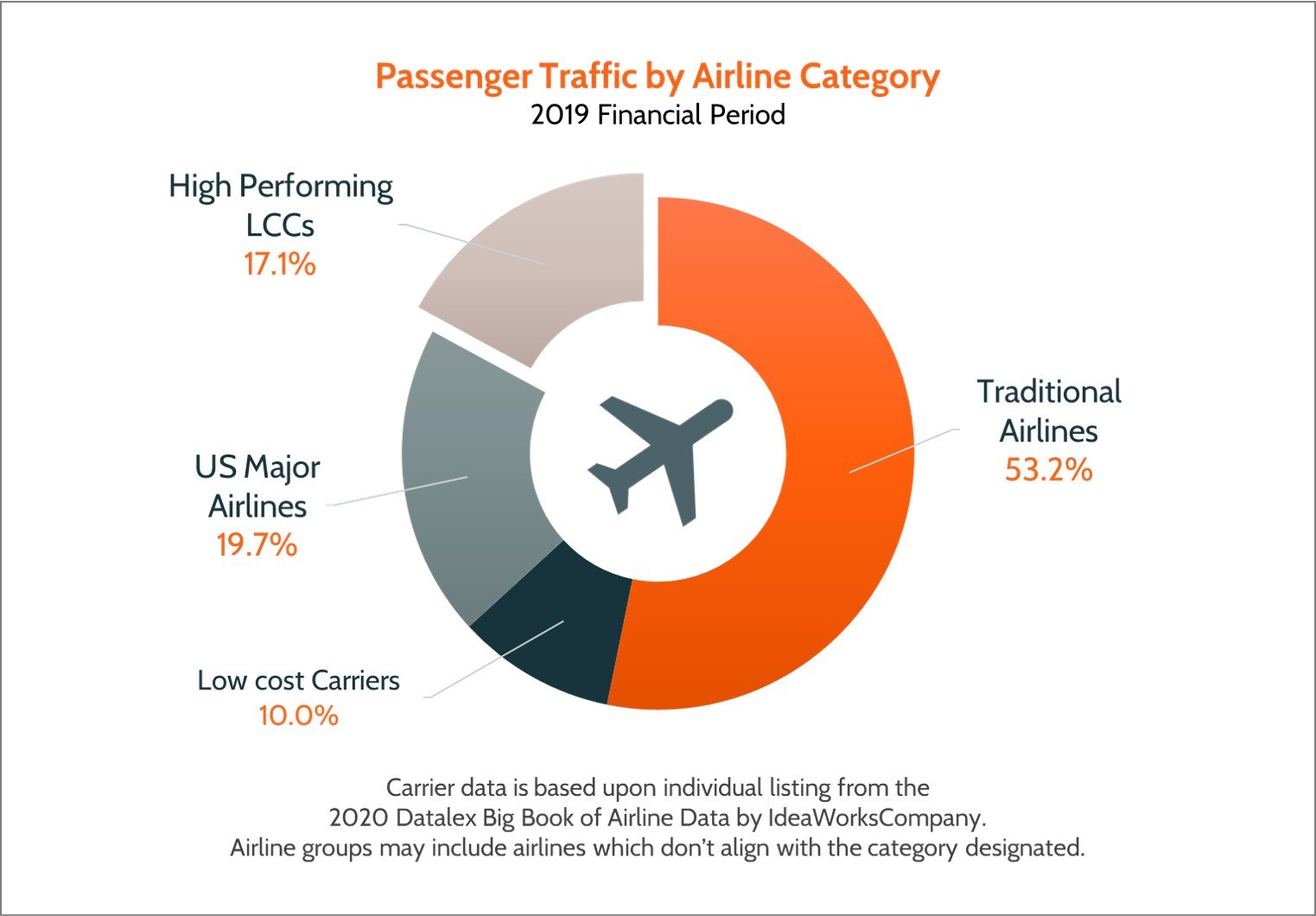

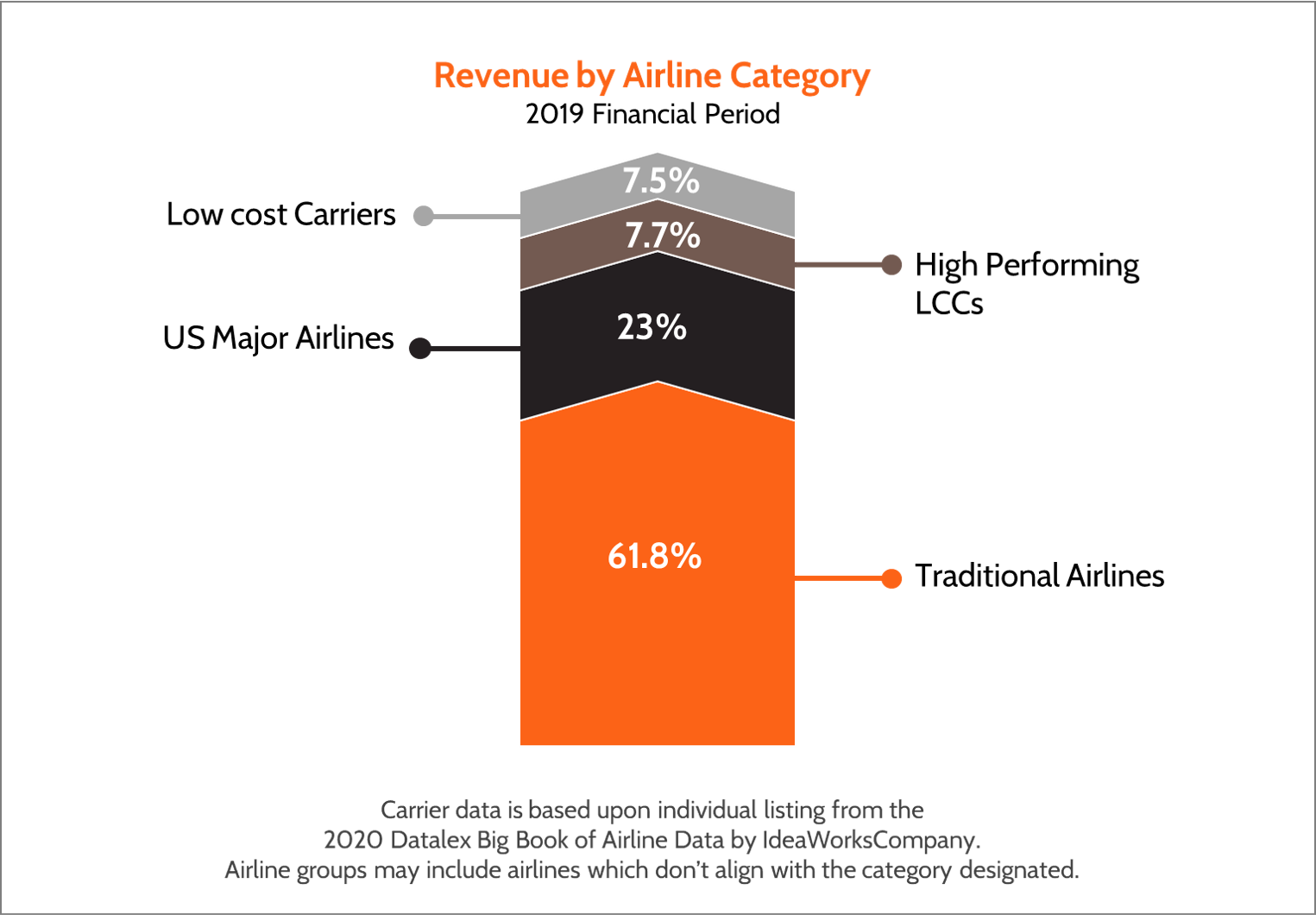

3. High Performing LCCs derive higher than average ancillary revenue – like Spirit Airlines and easyJet.

High Performing LCCs and standard LCCs are garnering 27.1% of total passenger traffic. Airlines might want to investigate how much impact LCCs are having on fares across the airline industry.

4. The Middle East & Africa region generates more revenue from a lower share of worldwide passengers.

Middle East & Africa revenue is 10.2% of the world total and just 6.2% of passenger traffic, which suggests higher yields. By comparison, Latin America's revenue is just 4.5% of the world total, with 7.3% of passenger traffic. This suggests lower yields for Latin America.

5. Six-out-of-ten passenger dollars are spent travelling on airlines affiliated with alliances.

The total worldwide revenue generated by alliances is nearly $500 billion.

6. While High Performing LCCs and standard LCCs are garnering 27.1% of total passenger traffic, they are only generating 15.2% of total worldwide revenue.

Some additional data points of note:

Ranking by Traffic:

- The top three airlines are US carriers – American, Delta, United

- Top 10 includes 3 China carriers – China Southern Group, China Eastern Group, Air China Group

- Top 10 includes 3 European carriers – Ryanair Group, Lufthansa Group, IAG

Ranking by Revenue:

- The top three airlines are US carriers – American, Delta, United

- Top 10 includes 2 China carriers – China Southern Group, Air China Group

- Top 10 includes 3 European carriers – Air France/KLM Group, IAG, Lufthansa

The reporting in the Big Book utilizes data from 2019. The data is therefore pre-Covid but the information provides excellent baselines for evaluating business during the Covid impact period and for planning for post-Covid business activities. The data can help carriers evaluate critical markets to target now and markets to focus on as travel increases. The data may also point to opportunities in product offerings and destinations that are going to entice consumers to spend on travel.

Because reporting requirements are different across countries and organizations, the team regularly had to dig through multiple reports and announcements to ensure the information presented for a particular airline was as accurate as possible and met IdeaWorksCompany standards for accuracy. It is critical to the IdeaWorksCompany team and Datalex that the information is as correct and as up to date as possible. Therefore, the data is regularly reviewed and any updates to the Big Book data are published here.